Indonesian

IndonesianProcedure to see document list

1. Use Tcode VF05

2. - enter the terms of retrieval. For example, now enter in “Payer”.

- Click

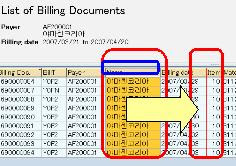

3. This screen will be display

Select the layout and click

4.

On the upper left click

5. Now the List of Billing Documents is appeared

6. To move column, Click title of selected column and move your cursor to the desired area, then release the click.

7. To save this layout, Select “Settings” – “Layouts” – “Save”.

8. enter ‘Save layout’

Back